HONG KONG and SHANGHAI, July 1, 2024 /PRNewswire/ -- China's growing senior population is bringing tremendous business opportunities to the financial services industry, says Michael Guo, Co-CEO of Ping An Insurance (Group) Company of China, Ltd. (hereafter "Ping An", the "Company" or the "Group", HKEX: 2318 / 82318; SSE: 601318). The aging population has low awareness of the need to plan ahead financially for senior care, and senior care services in the China market are fragmented and lack unified standards, Mr. Guo said at Annual Meeting of the New Champions 2024 in Dalian, commonly called the "Summer Davos".

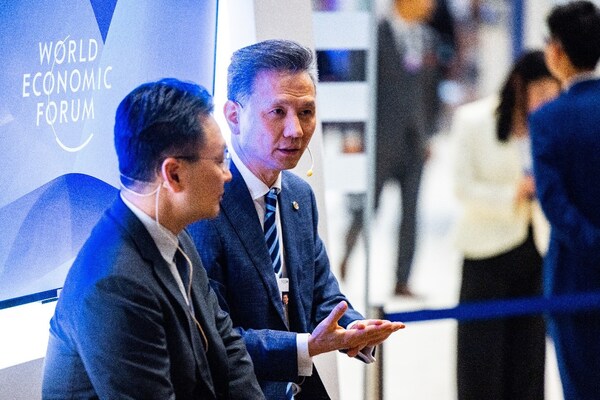

Michael Guo (right), Co-CEO of Ping An Insurance (Group) Company of China, Ltd., and Professor Chenyang Wei (left), Research Fellow, Director of Finance MBA Education Center, and Director of the China Insurance and Pension Research Center, Tsinghua PBC School of Finance at the “Summer Davos” in Dalian, China.

Ping An is taking a leadership role by building an "integrated finance + health and senior care" service system to provide professional financial advisory, family doctor and senior care concierge services.

China is aging before becoming rich, Mr. Guo said. When China entered the phase of an aging society in 1999, the GDP per capita was only US$1,000. In comparison, when developed countries in Europe and the US encountered aging populations, their GDP per capita was approximately US$10,000, so they had stronger financial capacity to support senior care. Today, the challenge in China is that retirement replacement ratio is low and whilst there is lack of awareness of importance of financial planning for senior care.

Demand growing for diversified and customized wealth and health services

"As average life expectancy increases, people will attach greater importance to pensions and start planning earlier," Mr. Guo said. "The demand for capital preservation and appreciation, with the goal of building a 'personal pension reserve', will become the core demand of wealth management."

China's insurance industry is aware of the market opportunities in wealth management for seniors and is working on designing "finance + senior care" products, he said. However, the product types are too generic. "Fulfilling the needs of seniors cannot be done by simply adding senior care products together, but should be a comprehensive solution, which is organically combined and adjusted to meet the customized demand of the seniors at different stages of their lifecycles," Mr. Guo said.

For example, seniors who are relatively healthy may want more social interaction, travel, hobbies and learning, to maintain physical and mental health. Seniors with chronic diseases would require appropriate disease management, and for some, disability care services.

China's senior care and healthcare services sector is still in its early stages. Challenges include service fragmentation, the uneven quality of services, processes, costs, and lack of unified standards and service monitoring systems.

Seamless integration of financial products and senior care

Ping An offers senior care insurance solutions that integrate healthcare and senior care services. This comprehensive service solution aims to meet the different demands of senior customers in health, medication for chronic diseases, and senior care. It includes financial products that offer insurance protection, wealth appreciation, wealth inheritance, and healthcare and senior care services, such as chronic disease management, health management, medical consultations and rehabilitation, residence security, guardianship and entertainment.

"The strength of Ping An lies in its ability to integrate providers into a comprehensive senior care service platform that can meet customers' personalized needs," said Mr. Guo. With a base of 234 million retail customers, Ping An understands the needs of end-customers and possesses the purchasing power to select the best service providers and set standards in the market."

Today in China, 90% of seniors choose home-based senior care. Ping An's home-based senior care services include Ping An Health's online diagnostic platform, which offers 24/7 treatment and consultation services. It has consolidated extensive offline healthcare service resources, including 100% coverage of the top 100 and 3A hospitals in China, nearly 50,000 in-house and contracted doctors, about 2,400 partner senior doctors, and 230,000 partner pharmacies. Integrating more than 100 suppliers, the in-home care offers a suite of 650 services and a 24/7 home-based concierge service in 54 cities, with more than 80,000 customers eligible for these benefits.

Technological Empowerment of the Senior Care Industry

"The entire financial insurance industry can leverage its own financial data and combine it with the senior care industry to accumulate data and continue to explore the empowering and enhancing the role of data and technology," Mr. Guo said.

Technological empowerment plays an important role in Ping An's senior care strategy. For example, home-based senior care is supported by an artificial intelligence (AI)-driven concierge. Currently, AI has been fully implemented in 200 scenarios for online concierge customer interactions and support for human concierges. AI will offer further assistance to efficiently empower homecare workers and nurses, leading to greater efficiency and quality improvements.

Another key aspect of technology in senior care is data application. Ping An possesses one of the world's largest healthcare databases, including a disease database, prescription database, drug database, doctor and hospital database, and personal health database. Data is sourced from public sources, including the National Health Commission, National Healthcare Security Administration, and National Medical Products Administration. The data has already been used in scenarios such as health insurance underwriting and claims and assisting users to find information on diseases, drugs, hospitals, and doctors.

About Ping An Group

Ping An Insurance (Group) Company of China, Ltd. (HKEx:2318 / 82318; SSE:601318) is one of the largest financial services companies in the world. It strives to become a world-leading provider of integrated finance, health and senior care services, Under the technology-driven "integrated finance + health and senior care" strategy, the Group provides professional "financial advisory, family doctor, and senior care concierge" services to its 234 million retail customers. Ping An advances intelligent digital transformation and employs technologies to improve financial businesses' quality and efficiency and enhance risk management. The Group is listed on the stock exchanges in Hong Kong and Shanghai. As of the end of 2023, Ping An had RMB11,583,417 million in total assets. The Group ranked 29th in the Forbes Global 2000 list in 2024 and 33rd in the Fortune Global 500 list in 2023.

For more information, please visit www.group.pingan.com and follow us on LinkedIn - PING AN.

source: Ping An Insurance (Group) Company of China, Ltd.

樂本健【年度感謝祭】維柏健及natural Factors全線2件7折► 了解詳情