|

First Large Language Model in the Foreign Trade Financial Industry

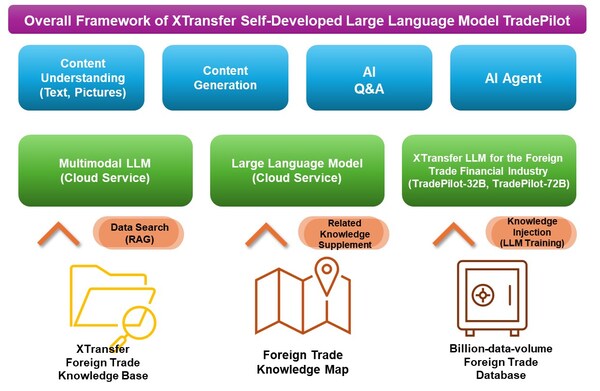

SHANGHAI, Sept. 11, 2024 /PRNewswire/ -- XTransfer, the World's Leading & China's No.1 B2B Cross-Border Trade Payment Platform, is delighted to announce the successful launch of TradePilot, its self-developed large language model (LLM) for the foreign trade financial industry. This marks a significant advancement in foreign trade financial services for B2B small and medium-sized enterprises (SMEs).

With the rapid development of artificial intelligence technology, particularly using LLMs in various fields, the foreign trade financial sector has also seen new opportunities for transformation. After years of technological research and innovative practices, XTransfer has successfully introduced its self-developed LLM TradePilot for the foreign trade financial industry, marking a new stage for foreign trade financial services for B2B SMEs. This also signals the beginning of the "intelligent emergence" era for the foreign trade financial industry.

Currently, multimodal, long-context and AI Agents are three important directions in the field of AI LLMs, each with unique applications and research value. Multimodal relates to artificial intelligence systems that can process and understand different data types, including text, images, sound, and video. These systems can extract information from multiple data sources and conduct comprehensive analysis and understanding.

As an artificial intelligence system capable of understanding and processing long texts, long-context LLMs can understand complex semantics and logical structures, and provide long text content through natural language understanding, machine translation, and more. Natural language processing (NLP) handles topics, emotions, and logical relationships in long articles.

AI Agent is an artificial intelligence system that can autonomously perform tasks, make decisions, and interact with other systems or users. These agents can be virtual (chatbots and virtual assistants) or physical (autonomous vehicles and robots).

These three directions in artificial intelligence are interconnected and collectively drive the development and application of technology. Today, as global trade continues to evolve, foreign trade enterprises face unprecedented challenges and opportunities. XTransfer is dedicated to reducing the barriers and costs of global expansion for SMEs through technological means, and to promoting the digital development of the foreign trade industry.

Last year, XTransfer began research and development on TradePilot, an LLM for the foreign trade financial industry. The goal is to improve the efficiency and security of payment and financial services using advanced data analysis and artificial intelligence technology. After multiple rounds of improvements, the model incorporates a significant amount of business data and market demand. It uses the latest LLM training and fine-tuning techniques to ensure exceptional performance in risk management, customer service, and more.

In June of this year, XTransfer completed the training of two versions of the self-developed LLM TradePilot. TradePilot competed with many well-known domestic and international LLMs, including GPT-4, in the foreign trade financial professional knowledge assessment and won first place in the overall score*. Initial feedback suggests that the model has significantly improved transaction security and efficiency while reducing costs for foreign trade SMEs. It is gradually being effectively applied in multiple domains.

In terms of risk identification and management, TradePilot, through powerful context reasoning and natural language processing capabilities, can accurately predict and prevent potential transaction risks, greatly enhancing the market competitiveness of foreign trade SMEs.

The shift of B2B foreign trade business from offline to online has accelerated in recent years. However, the B2B model still involves many offline activities, leading to scattered and unstructured transaction data. This presents a challenge for anti-money laundering (AML) risk control in the B2B cross-border financial industry.

XTransfer has developed a data-driven, automated, internet-based, and intelligent infrastructure for AML risk control infrastructure centred around SMEs, establishing a new standard in AML risk control for the B2B foreign trade financial industry. By utilising multimodal information extraction of LLMs, including proforma invoices, logistics documents, and bills, XTransfer has achieved automatic matching of buyers and sellers, audit, and account verification, further improving the efficiency of AML risk control.

On the customer service front, TradePilot has integrated XTransfer AI-based customer service, achieving significant advancements in semantic recognition and understanding, effective response capabilities, and engaging exploration capabilities. The AI-based customer service response rate has increased from 13% to 84.2%.

Moreover, to fulfil foreign trade companies' marketing and customer acquisition requirements, TradePilot's AI-powered website has created tens of thousands of websites, thereby reducing the barrier to creating foreign trade websites. "AI Staff" have also assisted numerous foreign trade businesses in achieving precise customer acquisition.

Regarding technical implementation, TradePilot adopts a distributed computing architecture, ensuring the efficiency and stability of data processing. At the same time, TradePilot placed high importance on data security and privacy protection from the outset, in compliance with international and regional laws and regulations. Through encryption technology, access control, and audit mechanisms, the model ensures the integrity and security of user data.

The successful implementation of XTransfer's LLM TradePilot for the foreign trade financial industry not only brings tangible benefits to foreign trade enterprises but also has a profound impact on the entire B2B foreign trade financial industry. With the model's promotion and application, it is expected to drive the industry towards a more efficient, secure, and intelligent direction. In the future, XTransfer will continue to focus on technological innovation to promote the digital development of global trade.

Li Weitong, Senior Technical Director of XTransfer, stated: "The successful implementation of our self-developed LLM for the foreign trade financial industry is an important milestone. It not only demonstrates our technological innovation capabilities but also showcases our deep understanding of B2B foreign trade and precise grasp of the needs of SMEs. We believe that as the model continues to improve, it will bring even greater value to foreign trade enterprises. We look forward to seeing more enterprises achieve greater success in the global market through our technology and services."

*Note: The evaluation is based on 5,000 foreign trade/cross-border financial-related test questions arbitrarily extracted from professional books, and the evaluation of the answers given by TradePilot and many well-known domestic and foreign large language models, with the main dimensions of factuality, relevance, and completeness, and the results of the evaluation by XTransfer's expert panel (without labelling the names of the large language models).

About XTransfer

XTransfer, World's Leading & China's No.1 B2B Cross-Border Trade Payment Platform, is dedicated to providing SMEs with secure, compliant, fast, convenient and low-cost foreign trade payment & fund collection solutions, significantly reducing the cost of global expansion and enhancing global competitiveness. Founded in 2017, the company is headquartered in Shanghai and has branches in Hong Kong SAR, the United Kingdom, the Netherlands, the United States, Canada, Japan, Australia, and Singapore. XTransfer has obtained local payment licenses in Hong Kong SAR, the United Kingdom, the United States, Canada, and Australia. With more than 550,000 enterprise clients, XTransfer has become the industry No.1 in China.

By cooperating with well-known multinational banks and financial institutions, XTransfer has built a unified global multi-currency clearing network and built a data-based, automated, Internet-based and intelligent anti-money laundering risk control infrastructure centred on small and medium enterprises. XTransfer uses technology as a bridge to link large financial institutions and small and medium enterprises around the world, allowing SMEs to enjoy the same level of cross-border financial services as large multinational corporations.

XTransfer completed its Series D financing in September 2021 and achieved unicorn status. The Company possesses a diverse composition of international investors, including D1 Capital Partners LP, Telstra Ventures, China Merchants Venture, eWTP Capital, Yunqi Capital, Gaorong Capital, 01VC, MindWorks and Lavender Hill Capital Partners.

For more information: https://www.xtransfer.com/

source: XTransfer

《說說心理話》 消費能獲取快樂?買不起,不如花光錢錢$$?「習得性無助」有何影響?一起看看正確理財觀念。► 即睇